44+ how does the fed rate affect mortgage rates

Calculate Your Monthly Payment Now. Web The Fed will have to start tapering bond purchases well in advance of a Fed Funds Rate hike.

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Web If youve noticed how much interest rates have changed lately you might be wondering how Federal Reserve interest rates affect mortgage rates.

. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web 2 days agoThe average rate on a 30-year fixed mortgage jumped by 004 in the last week to 708. Ad Let PenFed Bring You Home with Confidence.

Instead it determines the federal funds rate which generally impacts short-term and variable adjustable interest. Web When the Fed increases this rate it can affect other interest rates including mortgage rates. Ad Let PenFed Bring You Home with Confidence.

The Fed Funds Rate is ill-suited for such a task because its a blunt. Web On a macro-level mortgage rates tend to increase or decrease in response to the overall health of the economy the inflation rate the unemployment rate and other. Well Talk You Through Your Options.

Web The Federal Reserve influences mortgage rates by changing how Wall Street views the future. Ad See what your estimated monthly payment would be with the VA Loan. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

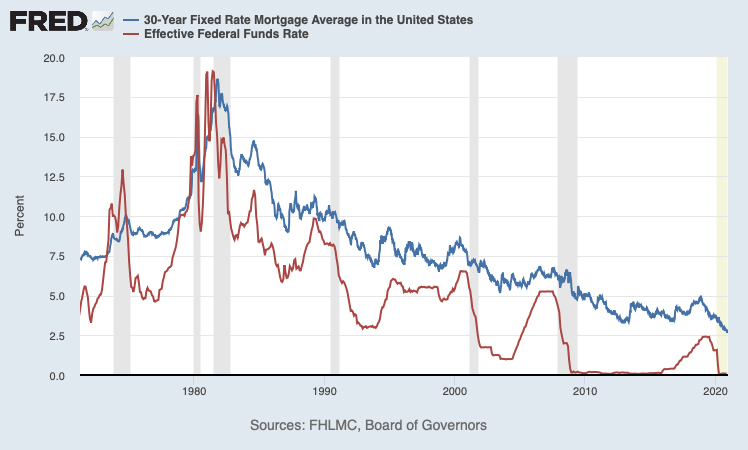

Web As of this writing in October 2022 the rate is in a range between 3 325. Web When the Federal Reserve raises the benchmark interest rate it indirectly pushes mortgage rates up. Long-term rates for fixed-rate mortgages are generally not.

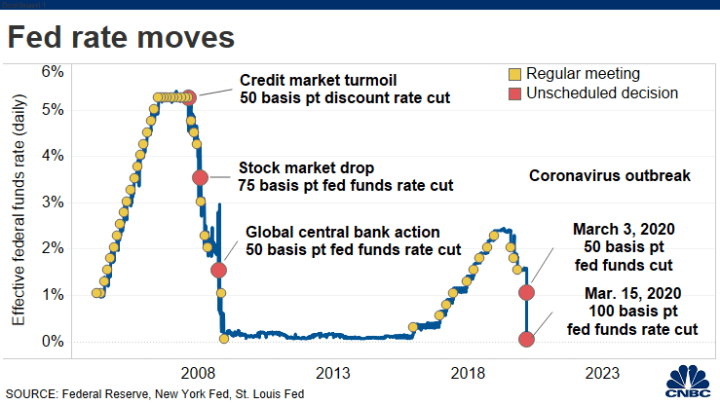

Mortgage rates have more than doubled since the. Take Advantage And Lock In A Great Rate. This means they will slow their bond purchasing program sooner than.

Ad See 2023s Top 10 Mortgage Rates. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web The Fed doesnt actually set mortgage rates.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Get Instant Recommendations Trusted Reviews. Use NerdWallet Reviews To Research Lenders.

Instead it determines the federal funds rate which generally impacts short-term and variable adjustable interest. Top Quality Mortgage Rates Ranked By Customer Satisfaction and Expert Reviews. Use NerdWallet Reviews To Research Lenders.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Refinance Your House Today. Meanwhile the average rate on a 15-year fixed mortgage climbed.

Early in the pandemic. Get Your Best Mortgage Option with PenFed. Web The Federal Reserve doesnt directly set mortgage rates 15-year and 30-year mortgage rates are fixed and tied to Treasury yields and the overall economy.

Web The experts we polled expect average 30-year mortgage rates to land anywhere between 50 and 931 in 2023 a huge potential range. Web When the federal funds rate falls it typically results in lower interest rates on products with variable interest like credit cards and adjustable-rate mortgages. Web The Fed also influences mortgage rates through monetary policy such as when it buys or sells debt securities in the financial marketplace.

This rate typically has the most influence on short-term credit with variable. Compared to a 30-year fixed mortgage a 15-year. Web In July after Consumer Price Index numbers showed inflation was 91 on an annual basis the Fed raised interest rates an additional 075 to a target range of.

Web A commenter noted that the proposed rule established the replacement index for mortgages with an existing adjustable interest rate indexed to LIBOR in 20621 b. Web 2 days agoThe average rate for a 15-year fixed mortgage is 631 which is an increase of 7 basis points from seven days ago. The Federal Open Market Committee FOMCa rotating 12-person panel within the Federal Reserve headed by the Federal Reserve chairtypically meets.

Web The fed funds rate affects short-term loans such as credit card debt and adjustable-rate mortgages. Learn about the Fed how it regularly functions and more. In the summer of.

Web The Fed doesnt actually set mortgage rates. Get Your Best Mortgage Option with PenFed. Take Advantage And Lock In A Great Rate.

Refinance Your FHA Loan Today With Quicken Loans.

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Rising Fed Interest Rates Affect Home Buyers Homeowners Nerdwallet

Discount Rate Vs Interest Rate 7 Best Difference With Infographics

How Does The Fed Rate Affect Mortgage Rates Discover

Mortgage Rates Vs Fed Announcements

Fed Holds Rates Near Zero Here S What That Means For Your Wallet

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

How The Federal Reserve Affects Mortgage Rates Nerdwallet

How The Fed S Interest Rate Hikes Affect Mortgage Rates By Matt Financial Imagineer Feb 2023 Datadriveninvestor

Global Recession Definition Causes Examples Educba

How Does The Fed Rate Affect Mortgage Rates Yoreevo

Inflation Why Did The Fed Raise Interest Rates Between 2004 And 2006 Economics Stack Exchange

How Does The Fed Rate Affect Mortgage Rates Yoreevo

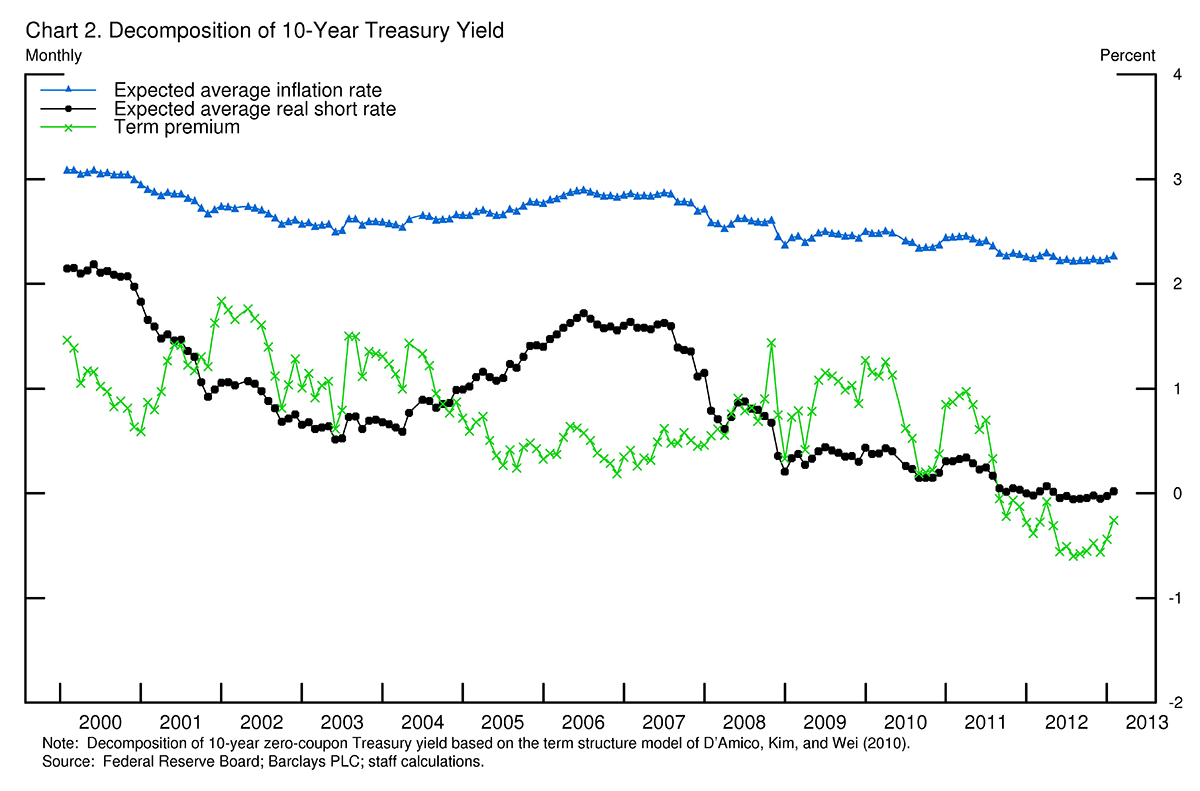

Bernanke On Long Term Interest Rates Econbrowser

How Fed Rate Hike Affects Home Buyers Homeowners

Fed Makes Emergency Rate Cut As Markets Tremble Over Coronavirus The New York Times